Employee 401k match calculator

A 401k can be one of your best tools for creating a secure retirement. The employer match helps you accelerate your retirement contributions.

401k Contribution Limits And Rules 401k Investing Money How To Plan

Ad Let Us Help Plan Your Financial Future with Courage Strength Wisdom.

. Achieve Financial Well-Being with Equitable Financial Life Insurance Company NY NY. New Look At Your Financial Strategy. Salary Your annual gross salary.

Step 5 Determine whether the contributions are made at the start or the end of the period. Investments That Adjust Over Time with a Goal of Carrying You To and Through Retirement. If your benefits see your contributions matched 100 it means that for.

There are a few different ways employers can match an. Calculate your earnings and more. The annual rate of return for your 401 k account.

Visit The Official Edward Jones Site. If you earn 60000. First all contributions and earnings to your 401 k are tax deferred.

A percentage of the employees own contribution and a. Ad Age-Based Funds that Make Selection Simple. Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals.

Youre eligible for match if you have completed one year of service and have Total. K Company Match Calculation. New Look At Your Financial Strategy.

Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track. The annual elective deferral limit for a 401k plan in 2022 is 20500. However employees 50 and older can make an annual catch-up contribution of 6500 bringing their total limit to.

First all contributions and earnings to your 401k are tax-deferred. A 401 k can be one of your best tools for creating a secure retirement. The actual rate of return is largely.

Many employees are not taking full advantage of their employers matching contributions. If the employee wants to withhold more than 4 percent of gross wages the benefit will match 50 percent up to 4 percent of the gross wages. This calculator assumes that your return is compounded annually and your deposits are made monthly.

How Matching Works. A 401 k can be an effective retirement tool. Some 401k match agreements match your contributions 100 while others match a different amount such as 50.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. The benefit will be calculated as. Apply your companys match percentage to your gross income for the contribution pay period.

Basic match 100 on the first 3 of compensation plus a. How frequently you are paid by your employer. Assume your employer offers a 100 match on all your contributions each year up to a maximum of 3 of your annual income.

Important Note on Calculator. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. It provides you with two important advantages.

The best 401k match would be a 100 match up to the allowable limits. If for example your contribution percentage is so high that you obtain the 20500 year 2022 limit. As of January 2006 there is a new type of 401 k -- the Roth 401 k.

Please visit our 401K Calculator for more. The JPMorgan Chase 401k Savings Plan match calculator is a tool for match-eligible employees. Using the calculator In the following boxes youll need to enter.

Employer 401 match programs usually incorporate two figures when calculating a total possible match contribution. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. Your expected annual pay increases if any.

Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. See How We Can Help. Step 6 Determine whether an employer is contributing to match the individuals contributionThat.

When an employee has a set dollar amount they contribute to each week and the company default is 3 QuickBooks is not recognizing when. For a matching contribution to meet safe harbor 401 requirements it must use one of the following three formulas. How to Calculate 401k Match in Excel.

For every dollar you contribute to your qualified retirement plan your employer will also make a contribution to your. It provides you with two important advantages. Visit The Official Edward Jones Site.

For example if your employer matches up to 3 percent of your gross income.

Fire Calculators App Our Debt Free Lives Retirement Calculator Budget Calculator 401k Retirement Calculator

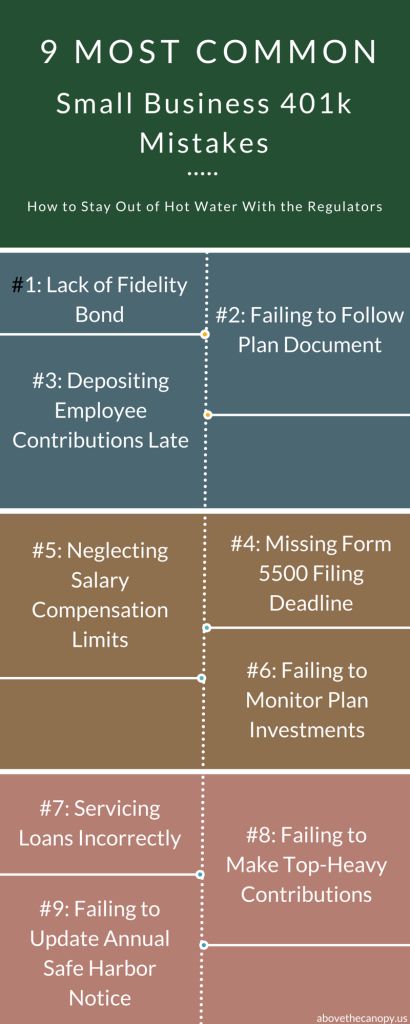

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k

Is Your Company S 5mm 401k Plan Paying More Than 1 25 All In Do You Even Know What You Re Paying We Can Help Https 401kspec 401k Plan How To Plan 401k

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k

Roth Ira Vs Traditional Ira Roth Ira Investing Traditional Ira Personal Finance Quotes

Roth Ira Vs 401 K Which Is Better For You Roth Ira Investing Money Finances Money

What To Do With An Old 401 K Fidelity Investments Investing Fidelity Money Management

What Is A Retirement Plan Retirement Planning How To Plan Investment Advice

Five Reasons To Consider A Roth Conversion Roth Conversation Traditional Ira

Investment Goals Investing Investing For Retirement Retirement Savings Plan

Retirement Savings Spreadsheet Spreadsheet Savings Calculator Saving For Retirement

401k Calculator For Excel 401k Calculator Savings Calculator Spreadsheet Template

Traxpayroll Solutions Traxpayroll Solutions Payroll Software Filing Taxes

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k

Simple Ira Retirement Plan For Small Business Owners Simple Ira Retirement Planning Ira Retirement

Here S An Example Of How After Tax Contributions Work An Employee Over Age 50 Can Save Up To 62 000 In A Workpl Contribution Retirement Benefits Savings Plan

Five Reasons To Consider A Roth Conversion Roth Conversation Traditional Ira